Rachel ClunBusiness reporter, BBC News

Getty Images

Getty ImagesThe share prices of leading UK banks have tumbled following calls for the government to introduce a new tax on banking profits.

Traders and investors reacted to suggestions that the government could raise up to £8bn a year with a windfall tax on the sector.

The proposal comes from the Institute for Public Policy Research (IPPR) think tank which argues it is a way to claw back taxpayers’ money which is being spent supporting the banking sector.

The Treasury said it did not comment on speculation over tax policy decisions, but said the government was “cutting red tape” for the City of London and putting financial services at the heart of its growth plans.

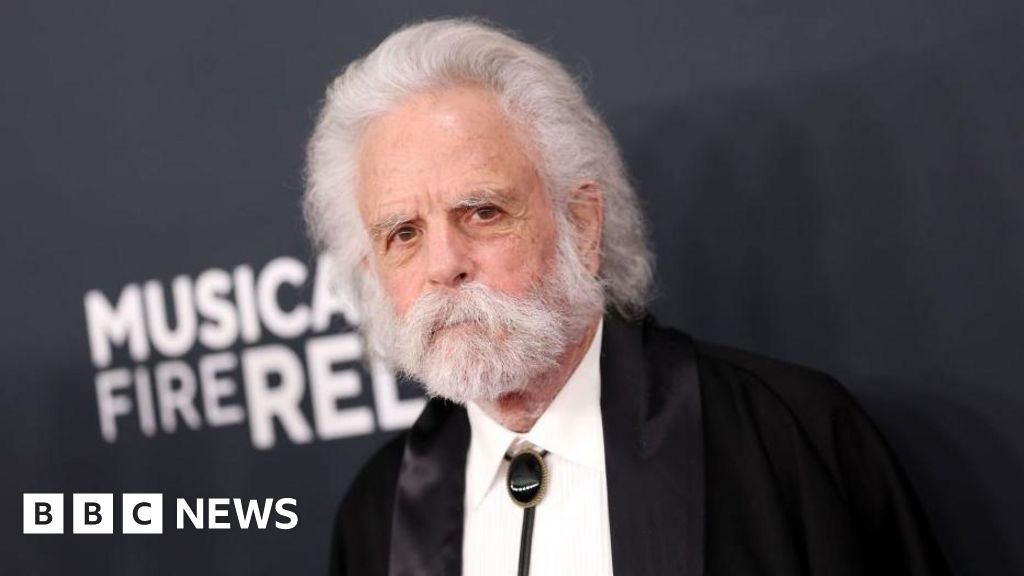

Banks were among the biggest losers on the UK share market on Friday with NatWest and Lloyds share prices down by more than 4% in morning trading.

By the end of the day their values had improved slightly but Natwest was still more than 4% lower, Lloyds was down over 3% and Barclays off more than 2%.

Charlie Nunn, the chief executive of Lloyds bank, has previously spoken out against any potential tax rises for banks in the government’s Budget announcement this autumn.

He said efforts to boost the UK economy and foster a strong financial services sector “wouldn’t be consistent with tax rises”.

The IPPR, a left-leaning think tank, said a levy on the profits of banks was needed as the Bank of England’s quantitative easing (QE) drive was costing taxpayers £22bn a year.

After the financial crisis and in 2020, the Bank of England began buying bonds – essentially IOUs it receives a fixed interest rate for – to support the financial sector and reduce longer term interest rates.

To buy these bonds, the Bank of England added new electronic money to the accounts of commercial banks that hold money with it.

While the Bank started reversing its QE strategy in 2022, it is still losing money on the programme because the interest rate it pays on those deposits has shot up, while the rate the Bank of England gets from the government bonds it holds has remained the same.

In addition, the Bank of England is making a loss on unwinding its QE programme as it is selling bonds at a lower price than it paid for them.

The IPPR said the Bank of England is now making huge losses, which it described as “a government subsidy to commercial banks”, and highlighted commercial bank profits compared to before the pandemic were up by $22bn.

The tax suggestion comes as Chancellor Rachel Reeves faces the difficult task of meeting her own self-imposed rules on taxation and spending when she sets out her Budget strategy for the next five years.

‘Bungled QE’

Carsten Jung, associate director for economic policy at IPPR and former Bank of England economist, said the Bank and Treasury had “bungled the implementation of quantitative easing”.

“Public money is flowing straight into commercial banks’ coffers because of a flawed policy design,” he said.

“While families struggle with rising costs, the government is effectively writing multi-billion-pound cheques to bank shareholders.”

Speaking on BBC’s Today programme, Mr Jung said the £22bn taxpayer loss was roughly equivalent to “the entire budget of the Home Office every year”.

“So we’re suggesting to fix this leak of taxpayer money, and the first step would be a targeted levy on commercial banks that claws back some of these losses,” he said.

A tax targeting the windfall profits linked to QE would still leave the banks with “substantially higher profits”, the IPPR report said, while saving the government up to £8bn a year over the term of parliament.

But financial services body UK Finance said that a further tax on banks would make Britain less internationally competitive.

“Banks based here already pay both a corporation tax surcharge and a bank levy,” the trade association said.

The corporation tax surcharge was introduced by the previous government in 2021, and is an 8% levy on the profits of banks, on top of the standard corporate tax rate.

The Bank levy, introduced in 2011, is another tax on banks’ business activities, but is based on banks’ balance sheets, or the scale of their business, rather than profits.

UK Finance said a new tax on banking would “run counter to the government’s aim of supporting the financial services sector”.

Russ Mould, AJ Bell investment director, said the UK stock market had soured following the suggestion, with investors wondering “if the era of bumper profits, dividends and buybacks is now under threat”.

A Treasury spokesperson said the government had taken action to boost the City’s competitiveness and make the UK “the number one destination for financial services firms by 2035”.

“We are a pro-business government, and the chancellor has been clear that the financial services sector is at the heart of our plans to grow the economy,” they said.

The Chancellor has worked hard since Labour won power to woo the City. In July, she announced her “Leeds Reforms” aimed at boosting investment. They include easing the rules brought in after the financial crisis to reduce risk in the financial sector, which the banks have argued are unnecessarily restrictive on their business.

But she is under pressure to find more sources of revenue in the run-up to her budget, after the government watered down its planned welfare savings and largely reversed winter fuel allowance cuts – decisions which narrowed her budget headroom.