Mark Telling’s personal details were stolen to set up a bogus company

In June this year, Tellings Home Made Furniture Service “borrowed” £50,000 from a government Covid bail-out scheme.

There was just one problem. The company isn’t real – the loan went to a criminal gang, who will never pay it back.

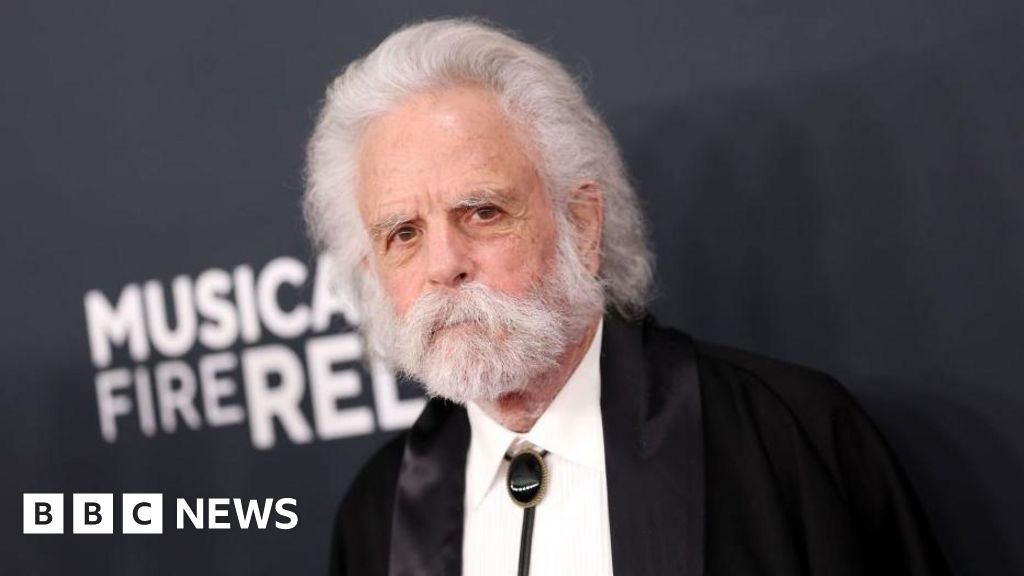

Mark Telling, though, does exist and had no idea a company had been set up in his name.

When we told him his personal details had been stolen to set up a bogus company to steal money from the government, he was horrified.

“That’s crazy, shocking, it’s going to worry us to death,” he said.

- UK banks get 100,000 loan applications on first day

- Arrest over £110k Covid small business loan fraud

Mark – who’s 47 and works in the building trade – and his partner are saving to buy a house.

“I don’t know what else is to come,” he added.

And Mark may be one of many. Victims could find themselves liable for the debt and have their credit rating badly affected.

Media playback is unsupported on your device

A BBC investigation has found criminals are setting up fake businesses on an industrial scale and successfully applying for government-backed Covid emergency loans – with no intention of paying the money back.

They claim up to £50,000 on each application.

The Bounce Back Loan Scheme – or BBLS – was announced in April and is designed to help small firms stay afloat during the crisis.

The loans are 100% backed by the government and do not have to be paid off for six years. They are interest free for the first 12 months, and are administered by 12 banks.

But we have uncovered evidence criminals are taking advantage of the system and could be making millions of pounds.

‘Scandal’

One fraud expert, a retired detective, has called it a “scandal” and said we may never know the true scale of the problem.

The Treasury insists banks are taking “appropriate precautions” and the government would take “criminal action against the most serious cases”.

The revelations come after the head of the National Audit Office told the Guardian the BBLS was the “riskiest” of all the bailout measures.

So, how does the fraud work?

Gangs steal victims’ personal details using phishing emails or buying them on criminal forums. They then set up a bogus business in their name.

After opening a business bank account they then apply for a Bounce Back Loan through the same bank.

The rules state the scheme should only apply to firms set up before 1 March 2020.

But we’ve seen successful applications for companies that were created as late as June.

‘Free money’

We met a fraud investigator who has successfully infiltrated a criminal gang online. His work is highly sensitive so he asked to remain anonymous.

He showed us the details of multiple people who had their personal details stolen, of businesses set up in their names and Bounce Back Loans applied for.

Typically the criminals apply for the maximum of £50,000.

The fraud investigator told us “it seems to be free money for the scammers”.

“There are hundreds, possibly thousands of people involved, engaged in this. It’s going to cost us billions,” he said.

We also obtained data from Companies House that indicates a sharp increase in the registration of new companies after the BBLS was announced.

In early March registrations were running at 15,602 per week. After lockdown that figure halved to 7,571 per week.

Chancellor Rishi Sunak announced the scheme on 27 April. Registrations then rose to a record 21,616 by the end of June.

We don’t know how many of those new companies might be fake – or how many actually applied for a loan.

Former detective and now civilian fraud and money laundering expert Martin Woods says the scheme was always vulnerable.

“Criminals identified it as a fabulous opportunity,” he said, adding there were inadequate checks on the applications that were made.

He added: “Ultimately, it will be our children and grandchildren who pay for this.”

Acuris Risk Intelligence, which tracks online fraud, claims to have found more than 100 fake businesses set up by one criminal gang alone.

Its CEO Joel Lange said: “This type of fraud could have been prevented by conducting even the most basic checks by the banks.”

UK Finance, which represents the banking sector, rejected the criticisms, saying: “Lenders have a range of checks in place to detect and prevent fraudulent activity.”

That includes “a cross-industry initiative to check if duplicate applications have been made”, it said.

Everything BBC News discovered is being made available to the authorities.