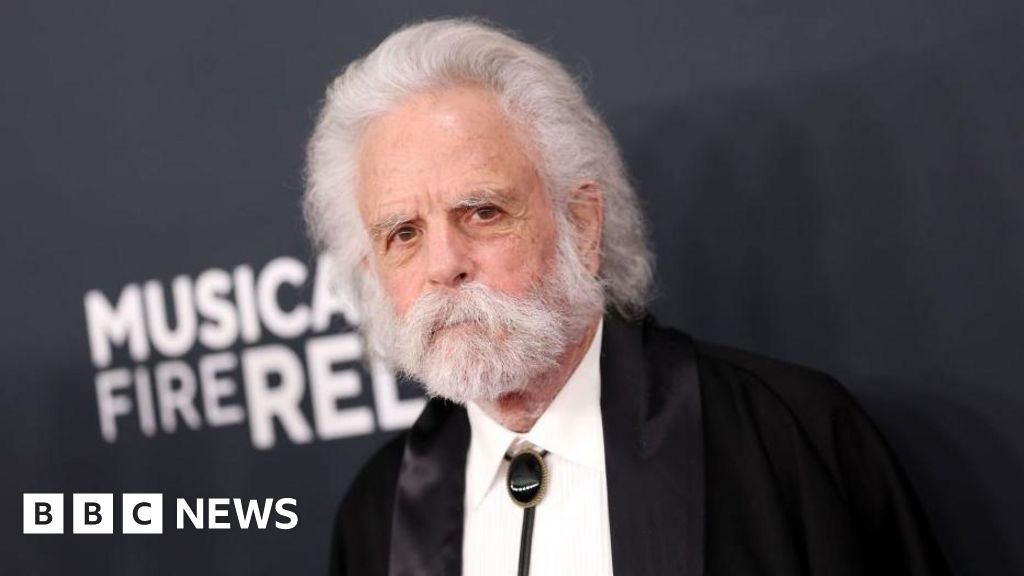

Image copyright

Getty Images

Grants for English firms forced to close in local lockdowns “will not be enough” to bail them out, the British Chambers of Commerce (BCC) has said.

The government unveiled the grants – worth up to £1,500 every three weeks – on Wednesday amid warnings of rising coronavirus infections.

Chief Secretary to the Treasury Stephen Barclay said they would be a “lifeline” for struggling companies.

But the BCC said more help was needed to protect businesses and jobs.

This week, restrictions were tightened in Bolton and Caerphilly amid spikes in infections. It follows local lockdowns in other areas including Leicester, Burnley, Hyndburn and Stockport.

But there have been complaints that firms in such areas get no extra support, despite having to shut their doors to the public.

- UK banks get 100,000 loan applications on first day

- Social gatherings over six to be banned in England

Mr Barclay said he understood the impact “these local measures have on people and businesses” as he announced the grants.

He told Parliament: “Closed businesses with a rateable value of £51,000 or less will receive a cash grant of £1,000 for each three-week period they are closed.

“For closed businesses with a rateable value higher than £51,000, the grants will be £1,500.

“The grants will cover each additional three-week period, so if a small business is closed for six weeks, it will receive £2,000.

“This new support will give closed businesses a lifeline through the difficult, but temporary, experience of lockdown.”

He said the grants could be used in conjunction with the low interest bounce-back loans available to firms in crisis.

However, the BCC said more help was needed as more than one in three of its members have three months or less worth of cash in reserves.

“Businesses forced to close through no fault of their own will welcome any new grant support, but for most this will not be enough to offset the resulting cash crunch,” said director general Adam Marshall.

“Ministers should increase the amount on offer to ensure businesses and jobs are protected, and extend coverage to more firms that are hard-hit but not forced to close.”