British artificial intelligence (AI) chip firm Graphcore – once considered a potential rival to market leader Nvidia – has been bought by a Japanese conglomerate.

Softbank has not disclosed how much it paid – but it is thought to be considerably less than the £2bn the UK company was valued at after a financing round in 2020.

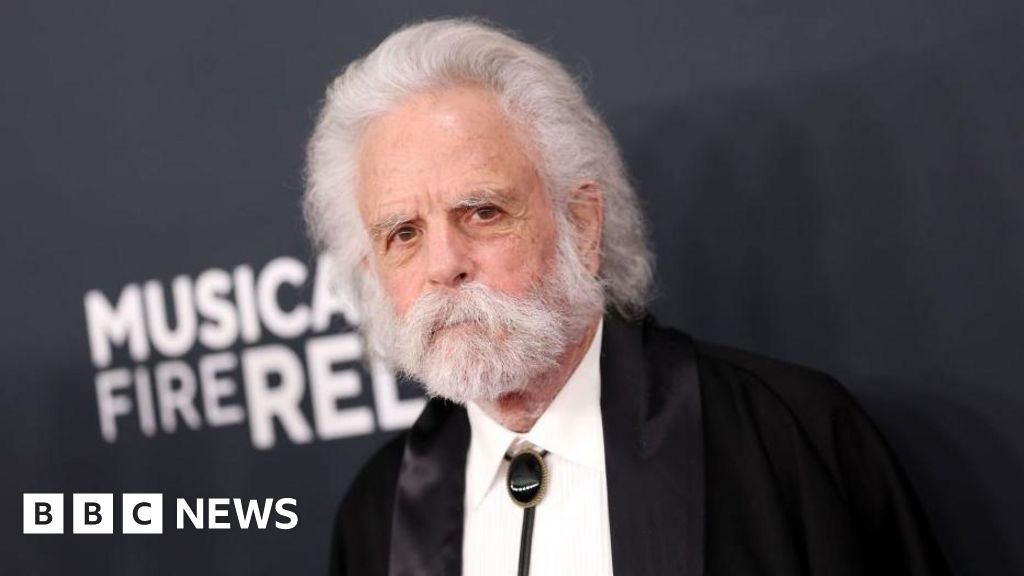

Graphcore head Nigel Toon told the BBC it was “a tremendous endorsement of our team”.

However, the deal is likely to raise questions about the UK’s ability to develop firms which can take on the biggest players in the booming AI chip market.

It is not the first time Softbank has acquired a promising UK start-up – in 2016 it controversially acquired another British chip designer, Arm.

Ben Barringer, technology analyst at Quilter Cheviot, said it was “another bitter blow” to UK financial markets to see Graphcore follow suit.

“It comes at a time when London is looking for a blockbuster tech listing to reinvigorate its reputation as a global financial centre,” he said.

The Science Secretary Peter Kyle called the deal a “welcome end to the uncertainty that has faced Graphcore and its employees”.

But he also admitted it was a “reminder of the important work that needs to be done” to make the UK “the best place to start and grow a business.”

Mr Toon said he believed the deal showed UK firms could compete with big tech, claiming Graphcore went “toe to toe with the largest companies in this space with a much smaller team with much less capital”.

“It’s really positive for the UK, bringing new investment here to help drive the growth agenda which as we all heard recently is so important.”

He said he would stay on as head of the company, and the move would lead to Graphcore hiring new staff in its UK offices.

The firm will now be a subsidiary under SoftBank but will remain headquartered in Bristol.

Though the sale price has not been made public, it has been reported that it is $500m (£390m).

Mr Toon said he would not “go into any of the speculation” around the sums of money involved.

But he did concede that the valuation of tech firms in general “have been up and down”.

“We’ve certainly seen a lot of other companies, their values have dropped and investors have taken appropriate cautious decisions about how they value investments on their books.

“Hopefully, as a result of this deal, we’ll see big investment and huge progress for Graphcore together with SoftBank.”

Graphcore was founded in 2016 by Mr Toon and Simon Knowles – its computer chips, the Colossus series, allow for powerful computer processing.

However it has struggled with slowing sales since its bumper 2020 valuation, and announced in 2022 that it had closed offices in Norway, Japan and South Korea.

Then in 2023, major tech investor Sequoia Capital said it had entirely written off the value of its stake in the company.

That was a major disappointment considering, at one point, Graphcore was seen as a potential competitor to Nvidia in the AI space.

Its would-be rival has grown significantly in value and briefly this year held the title of the most valuable company in the world.

“I think this is actually good news for UK tech and Graphcore,” said Dan Ridsdale, head of technology at Edison Group.

“Nvidia has carved out a dominant position in Generative AI… but there are other opportunities within AI and the industry will need viable competitors.

“But Graphcore will need substantial capital – it is a positive that Graphcore has found an investor willing to take the risk and provide the capital to put it in the mix.”